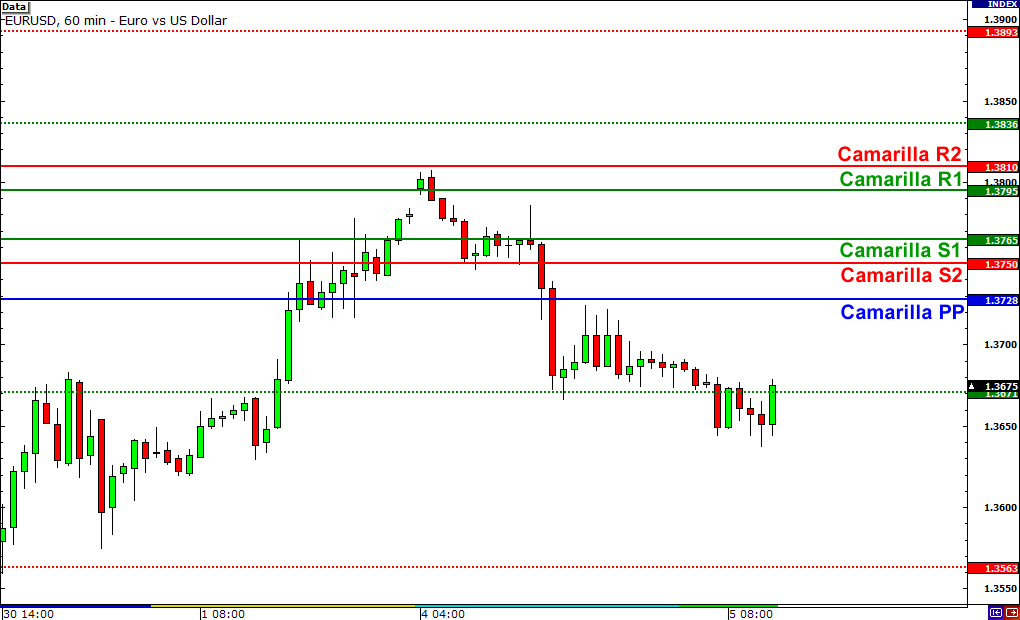

A modified version of the classic Pivot Point is called Camarilla Pivot Points.

Camarilla Pivot Points were introduced by a successful bond trader, Nick Scott in1989.

Camarilla Pivot Points basically hints that price has a tendency to revert to its mean until it doesn’t.

The use of Fibonacci numbers in its calculation of pivot levels makes it different than the classic pivot point formula.

Camarilla Pivot Points is a math-based price action analysis tool that produces potential intraday support and resistance levels.

Like classic pivot points, the previous day’s high price, low price, and closing price is used in it.

Camarilla Pivot Points are a set of eight levels that are similar to support and resistance values for a current trend.

These pivot points helps all traders in targeting the right stop loss and profit target orders.

C = Previous day’s close

H = Previous day’s high

L = Previous day’s low

R4 = (H – L) x 1.1 / 2 + C

R3 = (H – L) x 1.1 / 4 + C

R2 = (H – L) x 1.1 / 6 + C

R1 = (H – L) x 1.1 / 12 + C

S1 = C – (H – L) x 1.1 / 12

S2 = C – (H – L) x 1.1 / 6

S3 = C – (H – L) x 1.1 / 4

S4 = C – (H – L) x 1.1 / 2

The most important levels are S3.S4 and R3, R4.

R3 and S3 are the levels to go against the trend with a stop loss placed around R4 or S4.

A S4 and R4 are considered as breakout levels when these levels are breached its time to trade with the trend.

How to Use Camarilla Pivot Points

Camarilla Pivot Points provide guidelines for both sideways and trending markets.

Camarilla Pivot Points trading is based on open price on the next day (or session).

Depending on where price opens, the tool can suggest a trade that could exploit a reversion to the mean or a breakout to new highs or lows.

Here are five different scenarios showing how traders can trade with Camarilla Pivot Points.

Scenario #1: Open price is between R3 and S3

Buy when the price moves back above S3 after going below S3. Target will be R1, R2, R3 levels.

Place Stop loss at the S4 level

Wait for the price to go above R3 and then when it moves back below R3 again,sell or go short.

Profit target will be S1, S2 S3 levels and stop loss above R4

Scenario #2: Open price is between R3 and R4

Buy when the price moves back above R3 again after going below R3. Target will be 0.5%, 1% and 1.5% .

Place stop loss at R3

Wait for the price to go above S3 and then when it moves back below S3 again, sell or go short.

Target will be S1,S2,S3 levels, and the stop loss will be above R4. Target S1, S2, and S3.

Scenario #3: Open price is between S3 and S4

Wait for the price to go above S3 and then when it moves back above S3 again, thengo long.

Target will be R1,R2 R3 levels and stop loss below S4.

Wait for the price to go below S4 and then when it moves below S4,go short.

Place stop loss above S3. Target 0.5%, 1% and 1.5%

Scenario #4: Open price is above R4

Buying can be risky at this level. Wait for the price to go below R3.

As soon as the price moves below R3. go short.

Place stop loss above (R4+R3)/2. Target S1 , S2 and S3

Scenario #5: Open price is below S4

Selling could be risky at this level as the price has opened with a big gap down.

Wait for the price to go above S3.

When the price moves above S3, buy

Place a stop loss of (S4+S3)/2. Target R1, R2, and R3.

These are five scenarios on how to use Camarilla Pivot Points

For better results, try combining Camarilla Pivot Points with other technical indicators like Stochastic, RSI, and MACD.

A

Abandoned Baby | Account Statement Report | Account Value | Accumulation Area | Accumulative Swing Index ASI | Address | ADDY | ADP National Employment Report | Advance Or Decline Index | Afghanistan Afghanis | Agency Model | Aggressor | Alan Bollard | Alan Greenspan | Albania Leke | Algerian Algeria Dinars | Alligator | Altcoin | Analysts | Andrews Pitchfork | Angela Merkel | Angola Kwanza | Anti Money Laundering AML | ANZ Commodity Price Index | Application Programming Interface API | Appreciation | Arbitrage | Argentina Pesos | Armenian Drams | Aroon Oscillator | Aroon Up And Down | Aruban Guilder | Ascending Channel | Ascending Trend Line | Ascending Triangle | ASIC Mining | Asset | Asset Purchase Programme APP | Asset Purchases | Asymmetric Encryption | Asymmetric Slippage

B

Bag | Bag Holder | Bahmas Dollars | Bahrain Dinars | Bail In | Bail Out | Balance Of Trade | Baltic Dry Index | Bangladesh Taka | Bank Levy | Bank Of Canada BOC | Bank Of England BOE | Bank Of International Settlement BIS | Bank Of Japan BoJ | Bank Run | Bank Run | Banking Institutions | Bar Chart | Barbados Dollars | Base Currency | Base Rate | Basing | Basing Point | Bear | Bear Flag | Bear Market | Bear Trap | Bearish | Binary Options | Bitcoin Cash | Bitcoin Maximalist | Bitcoin Or BTC | Block | Block Explorer | Block Header | Block Height | Block Reward | Blockchain | Blue Chip | Bolivia Bolivianos | Bollinger Bands | Bond | Bond Auction | Bond Yeild | Book | Boris Schlossberg | Botswana Pulas | Brazilian Brazil Real | Breakdown | Breakeven | Breakout | Brent Crude | Bretton Woods Agreement Of 1944 | BRIC | Broadening Formation | Broker | BTD | BTFD | Bucket Shop | Bulgarian Leva | Bull | Bull Flag | Bull Market | Bull Trap | Bullish | Bullish Engulfing Pattern | Bundesbank | Burundi Francs | Business Inventories | Buy Side | Buying Pressure

C

Cable | Camarilla Pivot Points | Cambist | Cambodian Riels | Canadian Dollar | Cape Verde Escudos | Carbon Credits | Cardano ADA | Carry Trade | Cash Market | Catalyst | Cayman Islands Dollars | Cboe Eurocurrency Volatility Index | Central Bank | Central Bank Digital Currency | Central Bank Intervention | Central Counterparty Clearing Houses CCPs | Central Limit Order Book Or CLOB | Chaikin Oscillator | Chart Pattern | Chartist | Chicago PMI | Chilean Peso | Chinese Renminbi | Chinese Yuan | Christine Lagarde | Circulating Supply | Cleared Funds | Clearing | Clearing Price | Client | Closed Position | Cloud Mining | Coin Age | Cold Storage | Collateral | Colombian Pesos | Comdoll | Commercial Corporations | Commission | Commitments Of Traders Report Or COT | Commodity | Commodity Channel Index Or CCI | Commodity Futures Trading Commission CFTC | Commodity Research Bureau Index | Commodity Trading Advisor CTA | Communaute Financiere Africaine Francs | Comoros Francs | Completeness | Compound COPM | Comptoirs Francais Du Pacifique Francs | Conference Board Consumer Confidence Index CCI | Confirmation | Confluence | Congo Congolese Francs | Consensus Algorithm | Consolidation | Consumer Price Index CPI

ForexTrading.pk