Abandoned Baby is a Japanese pattern of candlestick formed by three candles in reversal manner. It contains two candles and one doji with bodies.

There is a gap before and after the doji. There must be gap in shadows on the doji or first and third candle must have a gap below or above the shadows.

Abandoned Baby is of two types:

- Bullish Abandoned Baby

- Bearish Abandoned Baby

The Abandoned Baby pattern is found rarely because specific criteria must be fulfilled by price movements to form a pattern.

The criteria identification of Abandoned Baby pattern Patter is given below:

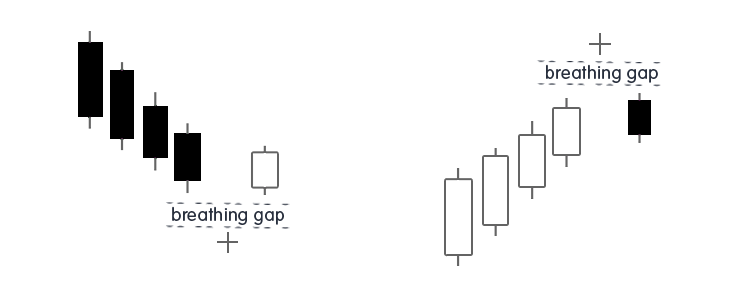

Bullish Abandoned Baby

- Downside must contain a large black or red candlestick

- There must be a doji after black candle that gaps below the close of the first candle.

- The last candle must be white (or green) and open above the doji in the three-candlestick pattern.

Bearish Abandoned Baby

- The upside must contain a large white (or green) candlestick

- There should be a doji after a white candle that gaps above the close of the first candle.

- The last candle must be black (or red) and open below the doji in the three-candlestick pattern

- Gaps must be in the first and second and second and third candles as well.

Neighboring candles must NOT overlap

- On overlapping, these would be a Morning Star or Evening Star candlestick pattern.

- The Abandoned Baby is a reversal pattern.

- There is a short break after a uptrend and downtrend, an uncertain situation (caused by the doji).

- After that momentum stars transferring suddenly.

- The bears take control and push the price downward when an uptrend occurred previously.

- The bulls take control and push the price upward when it was found a downward in past.

- This rapid shift signals a strong reversal.

- A strong reversal occurs due to this fast shift signals

- The reversal will be greater, if there’s a large gap

A

Abandoned Baby | Account Statement Report | Account Value | Accumulation Area | Accumulative Swing Index ASI | Address | ADDY | ADP National Employment Report | Advance Or Decline Index | Afghanistan Afghanis | Agency Model | Aggressor | Alan Bollard | Alan Greenspan | Albania Leke | Algerian Algeria Dinars | Alligator | Altcoin | Analysts | Andrews Pitchfork | Angela Merkel | Angola Kwanza | Anti Money Laundering AML | ANZ Commodity Price Index | Application Programming Interface API | Appreciation | Arbitrage | Argentina Pesos | Armenian Drams | Aroon Oscillator | Aroon Up And Down | Aruban Guilder | Ascending Channel | Ascending Trend Line | Ascending Triangle | ASIC Mining | Asset | Asset Purchase Programme APP | Asset Purchases | Asymmetric Encryption | Asymmetric Slippage

B

Bag | Bag Holder | Bahmas Dollars | Bahrain Dinars | Bail In | Bail Out | Balance Of Trade | Baltic Dry Index | Bangladesh Taka | Bank Levy | Bank Of Canada BOC | Bank Of England BOE | Bank Of International Settlement BIS | Bank Of Japan BoJ | Bank Run | Bank Run | Banking Institutions | Bar Chart | Barbados Dollars | Base Currency | Base Rate | Basing | Basing Point | Bear | Bear Flag | Bear Market | Bear Trap | Bearish | Binary Options | Bitcoin Cash | Bitcoin Maximalist | Bitcoin Or BTC | Block | Block Explorer | Block Header | Block Height | Block Reward | Blockchain | Blue Chip | Bolivia Bolivianos | Bollinger Bands | Bond | Bond Auction | Bond Yeild | Book | Boris Schlossberg | Botswana Pulas | Brazilian Brazil Real | Breakdown | Breakeven | Breakout | Brent Crude | Bretton Woods Agreement Of 1944 | BRIC | Broadening Formation | Broker | BTD | BTFD | Bucket Shop | Bulgarian Leva | Bull | Bull Flag | Bull Market | Bull Trap | Bullish | Bullish Engulfing Pattern | Bundesbank | Burundi Francs | Business Inventories | Buy Side | Buying Pressure

C

Cable | Camarilla Pivot Points | Cambist | Cambodian Riels | Canadian Dollar | Cape Verde Escudos | Carbon Credits | Cardano ADA | Carry Trade | Cash Market | Catalyst | Cayman Islands Dollars | Cboe Eurocurrency Volatility Index | Central Bank | Central Bank Digital Currency | Central Bank Intervention | Central Counterparty Clearing Houses CCPs | Central Limit Order Book Or CLOB | Chaikin Oscillator | Chart Pattern | Chartist | Chicago PMI | Chilean Peso | Chinese Renminbi | Chinese Yuan | Christine Lagarde | Circulating Supply | Cleared Funds | Clearing | Clearing Price | Client | Closed Position | Cloud Mining | Coin Age | Cold Storage | Collateral | Colombian Pesos | Comdoll | Commercial Corporations | Commission | Commitments Of Traders Report Or COT | Commodity | Commodity Channel Index Or CCI | Commodity Futures Trading Commission CFTC | Commodity Research Bureau Index | Commodity Trading Advisor CTA | Communaute Financiere Africaine Francs | Comoros Francs | Completeness | Compound COPM | Comptoirs Francais Du Pacifique Francs | Conference Board Consumer Confidence Index CCI | Confirmation | Confluence | Congo Congolese Francs | Consensus Algorithm | Consolidation | Consumer Price Index CPI

ForexTrading.pk